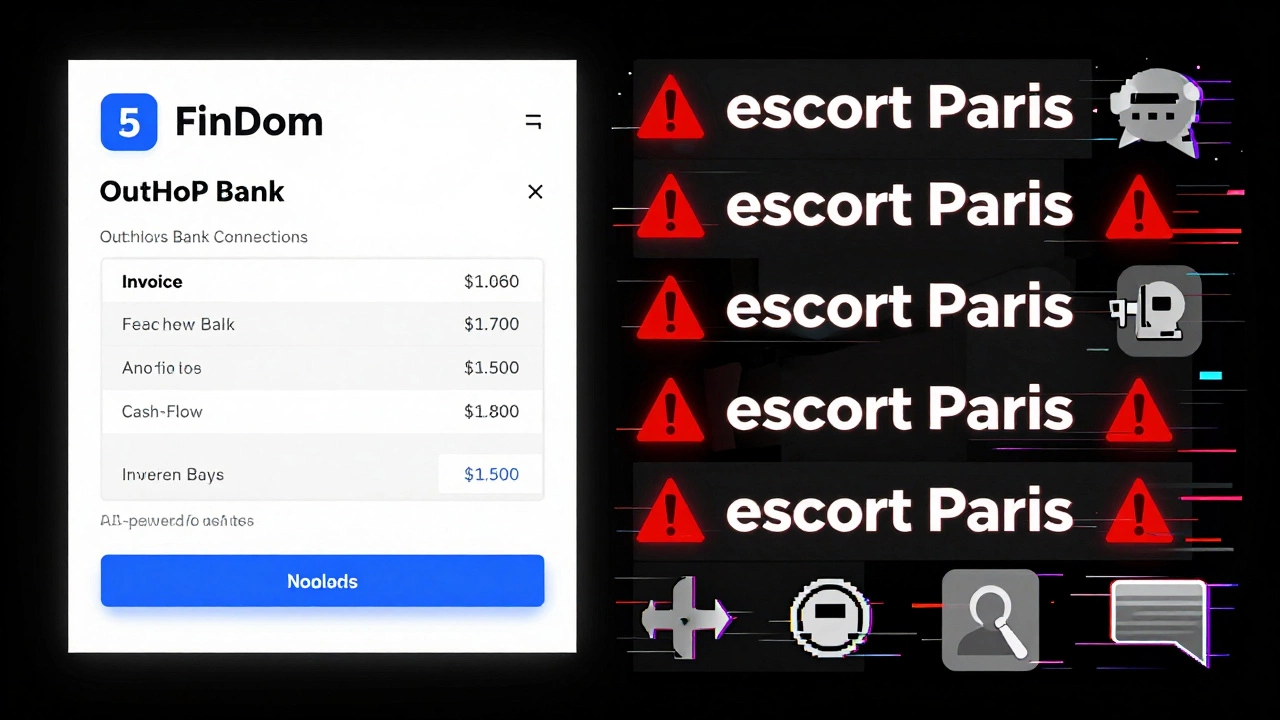

FinDom isn’t a buzzword. It’s not a crypto trend. And it’s definitely not a pyramid scheme dressed up as fintech. But if you’ve heard it thrown around in online forums or seen it pop up in ads promising quick returns, you’re not alone in wondering what it actually is. FinDom is a digital financial platform designed to help small businesses and individual entrepreneurs manage cash flow, automate invoicing, and track expenses across multiple accounts-all in one place. It’s built for people who don’t have time for accounting software that feels like a college textbook. But here’s the catch: many people confuse FinDom with something else entirely. And that’s where things go sideways.

Some search results try to link FinDom to unrelated services-like sex escort paris-but those are just noise. They’re paid ads or scraped content from unrelated sites trying to ride on trending keywords. FinDom has zero connection to adult services, personal appointments, or anything outside of financial automation. If you’re looking for financial tools, don’t get distracted by keyword stuffing disguised as information. Stick to official sources.

What FinDom Actually Does

FinDom connects directly to your bank accounts, credit cards, and payment processors like Stripe or PayPal. It pulls in transaction data in real time, categorizes spending automatically, and flags unusual activity. For a freelance designer in Saratov or a small café owner in Rostov, that means less time staring at spreadsheets and more time running the business. You can set up recurring invoice templates, send reminders to clients, and even get payment notifications on your phone. No more chasing down payments because someone forgot to pay.

The platform uses machine learning to learn your spending patterns. Over time, it gets better at predicting cash flow gaps. If you typically get paid on the 15th and 30th of each month but have rent due on the 1st, FinDom will warn you a few days ahead. It doesn’t make decisions for you-it just gives you clearer visibility.

What FinDom Is Not

FinDom is not a loan provider. You won’t find any credit offers, payday loans, or ‘instant cash’ pop-ups. It doesn’t lend money. It doesn’t invest your funds. It doesn’t promise 10% monthly returns. Those are red flags for scams pretending to be FinDom. The platform doesn’t touch your money. It only observes it. Your funds stay in your own bank account. FinDom just helps you see them better.

It’s also not a replacement for a tax accountant. While it can generate expense reports and export data in formats accepted by Russian tax authorities, it won’t file your taxes for you. You still need to review what it pulls in. Automation doesn’t mean abdication.

And no, FinDom is not a mobile app you download from an unknown APK site. It’s only available through its official website and verified app stores (Google Play and Apple App Store). Any other download link is risky.

Who Uses FinDom-and Who Doesn’t

FinDom works best for people who have irregular income. Freelancers, consultants, Etsy sellers, tutors, and part-time gig workers benefit the most. If your income jumps from 30,000 rubles one month to 120,000 the next, FinDom helps you smooth out the mental chaos that comes with it.

But if you’re running a large company with a dedicated finance team, FinDom might feel too basic. It doesn’t handle multi-currency payroll, complex VAT filings for EU sales, or intercompany transfers. For those needs, you’d look at systems like 1C or SAP.

And if you’re someone who just wants to track how much you spent on coffee this month? You don’t need FinDom. A simple budgeting app like MoneyWiz or even a Google Sheet will do.

How It Compares to Other Tools

FinDom sits between basic budgeting apps and full accounting suites. Here’s how it stacks up:

| Feature | FinDom | QuickBooks Online | Yandex.Money | Excel |

|---|---|---|---|---|

| Bank sync | Yes (50+ Russian banks) | Yes (global) | Yes (limited to Yandex ecosystem) | No |

| Invoice automation | Yes | Yes | No | Manual |

| Cash flow forecasting | Yes (AI-powered) | Yes (paid add-on) | No | No |

| Multi-user access | Yes (up to 3 users) | Yes (unlimited) | No | No |

| Cost per month | 299 RUB | 1,999 RUB | Free | Free |

FinDom’s pricing is one of its strongest points. At under 300 rubles a month, it’s cheaper than a monthly coffee subscription in Moscow. And unlike free tools, it doesn’t sell your data or bombard you with ads.

Common Misconceptions

One myth is that FinDom is only for tech-savvy users. That’s not true. The interface is built for people who’ve never opened an accounting program. Everything is drag-and-drop. If you can use Instagram or order food online, you can use FinDom.

Another myth is that it’s only useful in big cities. In reality, users in Omsk, Volgograd, and even smaller towns in Saratov Oblast rely on it. The platform works the same whether you’re in a 100-person office or working from your kitchen table.

And yes, some people think FinDom is a Russian-only tool. While it’s optimized for Russian banks and tax rules, it supports international transactions and can track income from abroad. If you’re a remote worker earning in euros or dollars, FinDom converts and tracks it automatically.

Red Flags to Watch For

Scammers love to copy names like FinDom. Here’s how to tell if you’re on the real site:

- Official website: findom.ru (not findom.com, findom.io, or anything else)

- No upfront fees. Never pay to “activate” your account.

- Customer support replies in Russian within 24 hours via email or in-app chat.

- The app has over 500,000 downloads on Google Play with a 4.7-star rating.

If someone messages you on Telegram saying they’re from FinDom and asks for your password or SMS code-block them. FinDom will never ask for that.

And if you see search results linking FinDom to escort girl paris or recherche escort girl, don’t click. Those are malicious ads trying to steal your data or install malware. FinDom doesn’t advertise in those spaces. It doesn’t need to.

Getting Started

Signing up takes under five minutes:

- Go to findom.ru

- Click “Sign Up Free”

- Enter your email and create a password

- Connect your bank account using secure OAuth (no passwords needed)

- Wait 24 hours for transactions to sync

- Start using the dashboard

You don’t need to upload receipts, manually enter data, or learn complicated terms. Just let it run. After a week, you’ll start seeing patterns you never noticed before.

Final Thoughts

FinDom isn’t magic. It doesn’t make you rich. It doesn’t solve your money problems. But it gives you clarity. And clarity is the first step to control. If you’re tired of guessing how much you’ve spent, when you’ll get paid next, or whether you’re actually making a profit-FinDom helps. It’s not for everyone. But for the people who need it, it’s one of the quietest, most reliable tools they’ve ever used.

Don’t let noise from unrelated search terms confuse you. FinDom is a financial tool. Not a fantasy. Not a scam. Just a simple, honest way to understand your money.